Temporary Staffing Agency Pricing Model

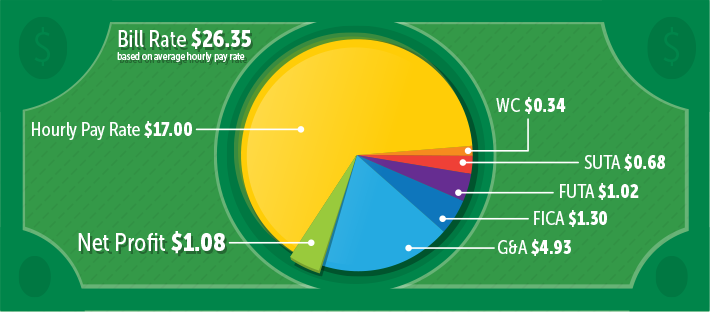

The staffing agency bill rate is the hourly amount you are charged for temporary services. Temporary staffing pricing models include two fundamental pieces of data: The Hourly Pay Rate and the Markup Percentage are used to calculate your Hourly Bill Rate.

If you're new to the staffing world, you may be wondering what is all included in the hourly Bill Rate charge. Let's start by identifying the two fundamental pieces of the equation. The Markup and the Pay Rate.

What is a Bill Rate?

The staffing agency bill rate is the hourly amount you are charged. In order to understand a staffing agency bill rate, you must understand two fundamental pieces of the equation.

Pay Rate: The hourly amount paid to the worker by the staffing firm. This doesn’t include any service charges.

Bill Rate Calculator= Pay Rate x Markup

What is a Markup?

Staffing agency markup rates are the fees charged to companies by the staffing agency.

Markup: is the percentage that is added to the pay rate. This number varies based on state labor taxes, benefits costs (workers' compensation, health insurance, etc) and the service charge for finding and placing the worker. Since this is based on a percentage of the pay rate, the cost can vary based on the worker’s experience, skills, length of assignment, industry, volume of employment need, so on.

What is Included in the Bill Rate:

Benefits and Taxes:

- Employer Taxes

- Local Taxes

- Payroll Taxes

- Social Security (6.2%)

- Medicare (1.45%)

- SUTA, FUTA

- Workers' Compensation (varies by state)

- Unemployment

- Short Term Disability

- Medical, Dental, Vision

Related Blog Post: Understand the Cost of a Full-Time Employee versus the Cost of a Temporary Employee Provided by a Staffing Agency

Sources: Image provided by The American Staffing Association (https://americanstaffing.net/)